Healthy habits and saving money

Health issues have the power to change a person’s outlook on finances and their management.

Many people are acquainted with the essentials of keeping a budget, or with tracking the outflows of their savings. Yet, few people incorporate savings for critical illnesses or budgeting for healthcare expenses into their budget keeping routines.

Essentials of financials related to healthcare (e.g. insurance) are rarely not taken care of. However, many can forget to search for useful tips on unconventional thinking related to financials of personal healthcare.

Read on to find more about essentials of finances and healthcare, and how fairly innocent actions can negatively affect a person’s health state.

Finances and your health

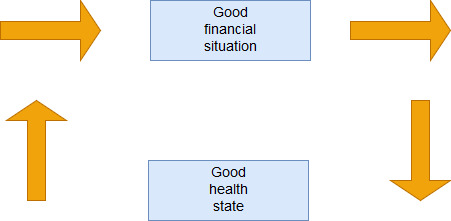

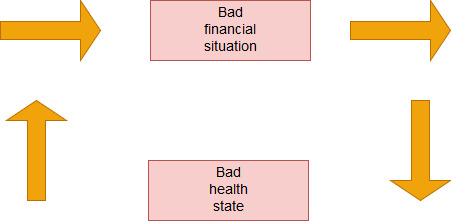

Finances and health are two aspects of life that deeply and continuously influence each other. Conventional thinking would suggest that a good financial situation positively influences the health of a person, and a good health state positively contributes to a person’s financial situation. Thinking rationally, the reverse should also be true.

However, scientific research presents a different conclusion. “Health and Financial Strain: Evidence from the Survey of Consumer Finances” points to a conclusion that a bad health state “increases the probability of financial strain”, yet the reverse is not true.

This means that: 1. Bad health affecting finances is a very real problem; and 2. People with a presently difficult financial situation, should not necessarily worry about its effects on their health.

From these conclusions, it becomes clear that solving a bad state of health, is the most valuable action a person can perform for their financial future.

One logical out-take of these conclusions could be that it may be more valuable to worsen a patient’s financial state in order to access the necessary treatments, rather than to forego treatments in an effort to maintain a better financial state.

A worsening financial situation isn’t always a clear contributor to a bad state of health. However, research suggests that this is still possible. People dealing with financial difficulties still should be concerned about their health state.

Health insurance

Health insurance is essential for proper healthcare. Without health insurance (either private or public), patients all over the world would cope with bigger costs of healthcare.

When looking at health insurance from the angle of healthcare finances, it’s important to note that private health insurance is a product similar to other goods. Meaning, private insurance providers may use psychological tricks to increase their sales numbers and revenue. Hence, people looking to buy a private health insurance plan should approach this task as shopping.

Approaching the task of choosing private insurance as shopping, will let potential consumers to identify common psychological tricks used by marketers to increase the sales of insurance plans.

An often encountered trick related to insurance is called anchoring. Anchoring is a rather simple trick: expensive items are placed next to cheap ones. This creates an impression of higher value in the mind of the consumer, and makes the cheaper prices seem like a great deal (which they may or may not be). In relation to health insurance, a very expensive option may be placed next to cheaper one. The quality of their packages will be more or less the same, but the less expensive option will look like a great deal compared to the very expensive option.

For patients living in countries with public health insurance, it may be important to remember the full scope of healthcare treatments and services public health insurance offers.

A person with private health insurance will likely know the ins and outs of their package. However, people living in countries with full coverage public insurance, can forget to acquaint themselves with all free or subsidized treatment options available to them.

Not knowing the full scope of free or subsidized healthcare services could lead to unnecessary spending on the patient’s side.

Accident insurance (accidental death and dismemberment insurance) is probably the best deal an insurance buyer can get. It’s cheaper than other types of health-related insurance, and offers protection extending beyond the definition of accidents.

Accident insurance, as its name states, is directed at compensation related to accidents. More specifically, at accidents that impact a person’s health or well-being. Examples of these are falls, broken bones and other injuries. However, accident insurance usually covers more illnesses and life situations than just broken bones.

Firstly, accident insurance tends to have pay outs related to the death of the insured. In Europe, the sum around 15,000 euros. In USA, it’s around 25,000 dollars. While it isn’t an exorbitant amount of money, it would be enough to help the family of the deceased to take care of funeral-related costs.

Secondly, accident insurance provides pay outs related to accidents which cause a disability. Dealing with a disability can be hard enough on its own. A financial pay out may be a needed boost.

Finally, accident insurance has pay outs related to healthcare and rehabilitation costs. An example would be accident insurance covering the costs of plastic surgery, because of an accident impacting the face.

Because of its relative cheapness, and the benefits accident insurance offers, it may be one of the better deals for consumers in the insurance industry.

Finances and health issues

Finances and health issues often create problems because of insufficient funds for treatments.

Health issues cause negative effects to a person’s financial state, and their finances may end up getting completely depleted. Avoiding this very real and common issue can be done through budgeting, adequate insurance, and unconventional thinking related to finances.

Savings for critical illnesses should be entirely separate from an emergency fund, and should only be used for their exact purpose. The unexpectedness of critical illnesses mandates that savings for them are used just for one purpose. A budget keeper could be using savings intended for critical illnesses one day, and getting diagnosed with one the next day. This situation is avoidable if savings for critical illnesses are used only for their purpose, and nothing more.

Finances and health issues won’t become a problematic topic for most people, if they take preventative measures in advance. Budget keepers should have entirely separate savings intended just for critical illnesses. Emergency or “rainy day” funds often end up being used not for their purpose. That’s an unavoidable fact of life, and using an emergency fund is still better than borrowing money (either through loans or from friends or family).

Everyday emergencies happen far more often than people get ill from serious illnesses. Hence, using an emergency fund both for everyday emergencies and serious illnesses, would just make the probability of insufficient funds for health treatments far larger.

The goal amount of savings for critical illnesses will vary between people, countries and cultures. Persons living in more individualistic and less inclined to charity societies, should save more. Persons living in more communal and more inclined to charity societies, can save less.

Determining the monthly critical illnesses savings rate, will be easier when the worst case scenario is considered. If a worst case scenario would require a person to spend 10,000 dollars or euros, then this sum should be the goal which is contributed to every month. 10,000 over 10 years is equal to 83.3 dollars or euros, put away to savings every month.

Adequate health insurance is also a necessary step for avoiding the negative consequences of not having enough funds for necessary treatments. Adequate health insurance protects patients from bearing the full costs of treatments, and from getting into debt because of necessary procedures. For Money Bear Club readers in countries with affordable or socialized insurance, the only barrier to it may be having to sign up for it. In contrast, Money Bear Club readers from countries like USA, where health insurance is complicated and costly, may encounter more difficulties with getting appropriate health care.

Many guides and hack lists for getting adequate health insurance have been published. They may help some persons dealing with the healthcare system in USA. Localized guides can also help people (from other countries), who are dealing with complicated access to basic healthcare. If all else fails, and having insufficient funds for health insurance becomes a likely reality, medical tourism, or even migration for cheaper healthcare, is an option.

Unconventional thinking related to finances is also an important factor in preventing having insufficient funds for treatments. Conventional thinking related to finances, and to finances of healthcare, would suggest that only saving money will be enough to prevent having insufficient funds for healthcare treatments.

Even in states with socialized medicine, not all treatments are compensated (especially if they present a high risk to a patient). Because of this, many patients encounter situations when an option for a healthier life is closed by a lack of funds. Even saving money specifically for critical illnesses, does not always guarantee that a patient will be able to cope with costs of alternative or non-compensated treatments.

That’s where unconventional thinking related to finances should be used. Human ingenuity tends to manifest in calamitous situations. Ingenuity related to finances for healthcare often offers simple solutions to very difficult problems.

One of the most popular examples of unconventional thinking related to avoiding having insufficient funds for treatment? Crowdfunding. Using platforms originally intended for businesses or products, has become a popular way of avoiding a lack of funds for treatments.

Other instances of unconventional thinking related to healthcare finances have been using generic drugs over brand name ones, comparing drug prices in different pharmacies, and using free government health programmes.

These methods follow the same logic: identifying alternative funding sources and finding gaps in healthcare systems that allow for cheaper treatments. This logic can be used to brainstorm many more unconventional ways of avoiding insufficient funds for treatments.

Health financial planner

People looking to save money should have a budget. Similarly, people looking to save money on health-related costs should also have a financial plan.

A health budget or financial planner should divide healthcare-related costs by their origin (required vs. chosen), their repetitiveness (frequent vs. uncommon), and by their causes (accidents and injuries vs. other illnesses).

Dividing healthcare-related costs by their origin will help budget keepers to optimize their budget keeping activities. If most healthcare-related expenses originate from required health spending, e.g. mandatory insurance, then the budget keeper won’t waste their time and energy researching best savings strategies for money spent by their own free will. Instead, their energy then would be focused on finding ways to decrease the required healthcare spending.

If most healthcare-related expenses originate from spending which is not required, but is chosen by the budget keeper, e.g. vitamins, then the budget keeper should focus on applying shopping hacks to health-related purchases. These include buying non-prescription medicine from countries where it is cheaper, couponing, and being aware of common psychological tricks pharmacies use to increase their revenue.

Identifying the intensity of repetitiveness of healthcare-related costs will help budget keepers to forecast their future expenses more accurately, and to prepare for them in advance. When the most frequently repeating costs are found, a budget keeper will have a more or less accurate forecast of their healthcare-related expenses.

By forecasting healthcare-related costs from the data of their repetitiveness, a budget keeper will be able to adequately allocate the necessary funds for them. Moreover, preparing for healthcare-related expenses in advance, will help to avoid the negative consequences from not having enough savings for them.

Dividing healthcare-related costs by their causes (accidents and injuries vs. other illnesses) will help to adjust the focus of healthcare spending, and to make better healthcare spending choices. An injury-prone person will benefit from premium accident insurance, far more than a person who is not easily injured. A budget keeper seeing that the majority of healthcare expenses are not related to injuries, could lead to more funds being allocated to a healthy lifestyle and use of preventative measures (e.g. yearly check-ups).

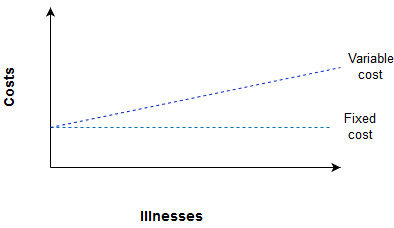

Fixed and variable costs

Health-related costs are composed of two parts: fixed and variable, similar to fixed and variable costs in business management. In the case of health-related costs, fixed costs are the costs which don’t change dependent on the number of illnesses a person has to treat. Fixed costs are costs like healthcare insurance, and costs of yearly check-ups.

In contrast, variable costs change dependent on the health status of the individual. E.g. more injuries tend to translate to more money being spent on injury-related medicine and medical products, like band aids or bone braces.

A health plan and its finances should reflect the individual’s fixed and variable costs related to healthcare. Fixed costs should be prioritized; variable costs should be forecasted. Funds for variable costs should be allocated in advance.

Prioritising fixed costs, like basic health insurance, will contribute to fewer worries about access to essential healthcare. Forecasting variable costs based on past spending trends, will help to better prepare for future expenditures.

Allocation of funds to variable costs in advance isn’t an essential step. However, if the financial situation of a budget keeper permits it, over-preparing and being “safe rather than sorry”, is always a good move in relation to personal finances.

When health supersedes savings

A topic which often gets left out in articles related to healthcare finances, is how saving money can negatively affect the health state of the individual. Saving money itself isn’t an inherently harmful factor for a person’s health state. However, there are instances when saving money or living frugally can negatively affect a person’s health state. These instances may not be very obvious, and identifying them can often take a lot of effort.

Saving money on the upkeep and utilities of a house, in the long-term, may negatively affect many areas of a person’s health. Lowering the temperature inside a house in an effort to save money on heating can contribute to higher rates of morbidity in elderly people and other health issues.

Another popular life hack related to saving money on utilities is re-using water, and using grey water. Money Bear Club has discussed how this hack can help to keep an extreme budget. Re-using water previously used for another purpose (e.g. to boil vegetables) won’t cause an illness. Yet, in some instances using grey water can contribute to higher numbers of pathogens in food.

An area where health should always supersede savings is purchase of groceries. Food, and its quality, can play a critical role in how successful a person will be. The food people eat, influences the quality of their gut microbiota. A healthy microbiota in infancy positively affects a person’s quality of life. Gut microbiota composition also depends on a person’s weight. This means that saving money on food, if it means eating less nutritious meals, should be avoided.

Although not all savings practices have the possibility to negatively affect a person’s health, identifying them can be hard, and the negative consequences of them can be really unhealthy. Thus, it can be useful to think about possible negative effects of money-saving practices, even if they seem harmless at first glance.

Probability and health

Above all, health issues are hard to predict. Apart from illnesses related to a person’s lifestyle and environment, other illnesses strike unexpectedly.

Everyone’s probability of getting a critical illness is different. Some people will have to cope with difficult illnesses all of the time, and some people may live all of their lives without even catching a cold.

Yet, no one can be 100% sure that they will be spared from a difficult illness. Thus, budgeting, saving, and preparing for them, becomes an essential financial defence against an unknown future threat.

Disclaimer: this article is solely an opinion of the author. The article is not intended to be taken as professional advice.

Want more articles? Support Money Bear Club on Patreon!

↓Share this article↓

yo this post very interesting

LikeLike