Fintech apps in 2019

Fintech (financial technology) is the burgeoning sector in finance and banking industries. Fintech apps are the meeting point of financial services and technology (particularly IT), to create more customer-friendly solutions.

Fintech apps and services can be broken down to several most important spheres. They are investments, lending and banking, and payment processing. Personal finance services and financial regulation solutions (RegTech), are also financial technology spheres.

Fintech services related to banking and investing tend to receive more attention than other financial technology spheres. Yet, payment processing and personal finance solutions can offer very interesting and creative solutions to common financial challenges for individuals and businesses.

Recognising new ideas in Fintech, and detecting trends, is important both to the potential users of financial technology applications, and to those working in the Fintech industry. Money Bear Club has analysed new Fintech apps, and found conclusions relevant to both of these user segments.

Money Bear Club asked 4 new Fintech apps released in 2019 (or about to be released in 2019), about their advantages over other similar apps, and hidden abilities that set them apart.

Read on to find more about new Fintech apps released in 2019, their limitations, advantages, and the trends in the Fintech industry that they represent.

Nexves

Nexves is the Fintech app which strives to help its users to save money, and not to overpay their bills. That’s an uncommon, and yet a very needed goal for financial technology apps.

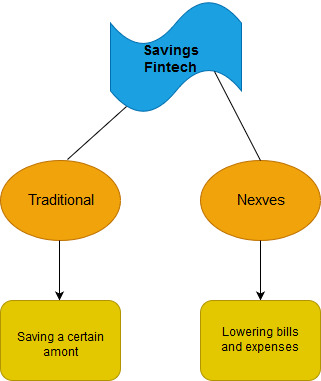

This Fintech app from a startup is a trend disruptor. Fintech apps created with an intent to help their users to save money exist. But those apps focus on saving certain amounts, or more commonly, percentages related to historic spending trends. Nexves is different. The app actively works to minimize the everyday bills and expenses of its users.

Since the Nexves app is still in the beta testing phase, Money Bear Club can’t release the images of the app or its capabilities. Yet, Money Bear Club can attest to the fact that its developers are putting in effort to make using the app, and the user experience related to the on-boarding process, as easy and as comfortable to the users as it is possible.

Although smaller details, especially those directly related to the customer experience, are often only addressed when an app is officially released, Nexves is doing the opposite. This Fintech startup is addressing the little difficulties in user experience in the beta phase, and not putting them for correction in the later phases of app development.

One limiting factor for this app’s growth could be its design. The current design differs from the most popular app design trends. This could mean that some users could be unsatisfied with it. However, it could also be a powerful differentiator from similar finance and Fintech apps.

Design is often the latest area app developers think about during the alpha and beta testing phases. Design problems are addressed and improvements are performed during the later phases of the app development. However, appropriate design choices improve user experience, and could help to attract more users.

Doing “social good”, which is the corporate message of the startup, is a good selling point, and could help to distinguish the company from other similar startups. Since “social good” is a rather rare corporate message in the Fintech industry, using it could help Nexves to differentiate itself against its competitors.

Chris Herd, the CEO of Nexves, gave more insights on the chosen strategy for this Fintech app. Mr. Herd said that the mission of Nexves is:

[…] to help every single person in the world pay the lowest price for all their bills and expenses, without having to do a thing after signing up, forever, for free.

When asked about “What are the advantages the Nexves app has compared to other similar apps?”, the CEO of Nexves answered:

We [Nexves] aggregate your data and let you leverage [it].

The mission of Nexves, combined with its advantage over other similar apps, lead to the conclusion that the right execution of this app could be very valuable to people looking to save money. The promise of a few hidden Easter eggs in the app from the CEO of Nexves, also adds to this conclusion.

Huawei Pay

Huawei Pay is the easy payment solution created for owners of Huawei devices. It currently works on 10 device series, which include Mate 20, 10, and 9 series, and the P20 and P10 series. Huawei Pay allows its users to pay just by using their smartphones, and offers the convenience of not having to use physical cards.

Huawei smartphones currently take up 15.8% of the world’s smart phone market, and 16.1% of Europe’s. If Huawei Pay were to become available in Europe, even with low adoption rates of this Fintech solution, it would still become one of the most-used native mobile payment services.

The main advantage of using Huawei Pay over other contactless payment providers, is its seamlessness of use. The app has a design with a modern feel to it. The UI presents a clean and an easy-to-navigate experience to its users.

The design of this Huawei Fintech app manages to perfectly capture the trend of minimalistic elegance, which has been very popular in the last few years. The app isn’t overloaded with unneeded information, or functions which are unhelpful for its users. In contrast, the Huawei Pay app, as it states, offers a “[…] easier […] mobile payment”. Just four app tabs (Pay, Default Card, Cards, Me) add to the simplicity of the app use, and deliver only the functions the user has a use for.

The Huawei Pay service is currently limited by location and by available banks. Apart from China, the contactless payment service is currently live in Russia, where clients of two local banks can use it.

An obvious limitation of Huawei Pay is the type of device it can be used on. Only Huawei mobile devices support this Fintech app. Moreover, some older Huawei mobile devices do not support it.

When looking from the perspective of Huawei smart phone owners, this wouldn’t be a limitation. In contrast, using a native app from the same developer as the smart phone is from, would be a sure and a rational choice.

Huawei Pay captures the trend of smart phone companies branching out to Fintech. The most well-known example of it, Apple, has delivered a popular and an easy to use contactless payment solution. Only time will tell whether Huawei will manage to leverage its user base to deliver a similar, or a better result.

Huawei did not respond to Money Bear Club’s questions.

fdpay

fdpay is the mobile payment service created by the First Direct bank. Among other functions, fdpay is a Fintech service, which enables the clients of First Direct to send payments to other people during the use of social media and messaging apps. This has been achieved through the development of a custom payment keyboard.

This Fintech payment service from First Direct perfectly captures the trend of simplified mobile payments. Apps like Cashapp and Venmo, one of the earliest pioneers of simplified mobile payment services, have brought the idea of easy payments to the public. fdpay, and other similar payment and banking apps, are creating more opportunities for their customers from this idea.

Taking the idea of simple payments, and implementing the ability to make payments by just using a phone’s keyboard has been an innovative idea from fdpay. Taking one of the most popular problems explored by financial technology, and expanding on it through an innovative solution, is likely to be popular with customers of First Direct bank.

The Fintech service belongs both to the banking and lending, and to payment processing sectors of financial technology. This has a positive impact on the users of fdpay. They don’t have to deal with two separate services (banking and payment processing) to use this app. Having to use one less service, when transferring money, allows users to save time they would have spent dealing with more than one service or app.

The fdpay smart payment service can only be used by the clients of the First Direct bank. This means that the innovative and convenient way of making payments by only using a custom keyboard, is not accessible to the wider population, unless they are the clients of the First Direct bank. To make payments by using this innovative payment technology, both the person sending the money, and the one receiving it, have to have the Paym service activated.

First Direct did not respond to Money Bear Club’s questions.

Bonus: HyperJar

HyperJar is a yet unreleased Fintech app, scheduled for release in spring of 2019. As of the time of the article writing, just under two months of spring have been left.

The corporate communications of HyperJar give the impression that it will be a debit-based payment service. Before the launch of the app, it is difficult to identify what will set apart the app against its competitors. However, the “paying upfront, enjoying later” concept is repeated several times in the article.

Money Bear Club can only guess how this concept will be implemented in a way that differentiates this Fintech app from many other similar services, which don’t offer a credit line. Either HyperJar will encourage future payments of its users in advance, or it will heavily emphasize historical spending data (in a bid to encourage its users to pay or save money in advance).

The structure of the app, as seen from its screen, suggests that it will be focused on the historical data of user spending. The “Activity” and “Analytics” tabs will likely feature latest user spending data, and the historical trends and patterns of it.

If the app will choose to use the historical spending data as a way to encourage “paying upfront, enjoying later”, it could attract users which prefer the analysis of statistics in relation to their personal finance.

If the app will choose to prompt its users to make payments in advance, or if it will use some other similar innovative idea, it could become a real disruptor in the Fintech app industry.

HyperJar responded to the inquiry by Money Bear Club, but could not give a comment on the app, as of the time of writing, it hasn’t yet been launched.

The future of Fintech

The future of Fintech, according to the newest apps released in 2019, is moving towards helping individuals make easier payments, and to changing the way individuals deal with expenses.

Easier payments, especially ones focused on time-saving measures for payment service customers, represent the main trend in Fintech in 2019.

Changing the way individuals deal with expenses, either through direct bill reduction, or the change when the payment is done, are two interesting ideas being explored through new financial technology apps in 2019. Fintech savings apps are a new trend in financial technology.

These ideas suggest that the future of Fintech is still strongly directed at solving important finance-related problems of retail customers. Apps focused at delivering a superficially better experience, or lifestyle-related services, would have a hard time finding a niche in financial technology in 2019.

Professionals working in the Fintech industry and its startups, should note that the focus on retail customers, instead of businesses, is still going strong. Financial technology professionals could capitalize on the lower supply of Fintech apps created for meeting the needs of businesses.

Financial technology business founders and investors should be aware of the trend of Fintech apps focusing on the way people deal with their expenses. Investing or developing apps based on the same or similar ideas could be an appropriate choice in 2019.

On the other hand, going against the grain, and being contrarian, could be a better choice. In this case, looking into other sectors of Fintech, like RegTech or investments, would be contrarian choice.

Want more articles? Support Money Bear Club on Patreon!

↓Share this article↓

One thought on “New Fintech Apps and Trends in 2019. Nexves, Huawei Pay, fdpay, HyperJar”